In order for my analysis to have validity I’d like to examine both the positive and negative aspects of the Tenant Protection Act also known as AB 1482. In general, tenant protection and rent cap laws, commonly referred to as “Rent Controls”, take on negative connotations.

I’ve learned that most consumer protection policy and legislation fail because the side that has the majority disregards the input of the opposition. This is not about coming to a happy median or splitting the difference it’s about truly listening to the facts and evaluating the evidence provided to make the right decision. The best way to solve a problem is by understanding the other person’s point of view.

In this next series, I’m going to examine the Pro’s and Con’s to AB 1482 and at the end conclude how this bill will impact the real estate market based on data. As stated in the subject title, this post will review the PRO’s for landlords, tenants, and policy makers in a bullet point format making it easy to follow.

- Single-Family Residences (SFRs), Condominiums, and Duplexes where an owner resides in one of the units are EXEMPT…unless it’s owned by a large corporation or a managing member within an LLC that’s owner of a corporation.

- Local ordinances take priority over AB 1482 so long as they include Just Cause clauses. This is a positive for owners that already know how to navigate through rent controls in their respective market. The only caveat that I see is that buildings 15 years built in 2005 or newer are exempt which overrides the 1995 Costa – Hawkins Act.

- Allowed annual rent increases of 5% plus the local consumer price index (CPI) but not to exceed 10% which ever is less.

- VACANT units are exempt from rent control. If a unit is vacated or vacant then an owner can rent at a market rate regardless of the occupied lease rates within the complex. This should give owners incentive to renovate any vacant units to maximize the rent to attract a quality tenant.

- Units occupied by the owner, parents, grandparents, kids, or grandchildren of the landlord are exempt.

- Rent Increases are scheduled for both the property owner and the tenant. There’s no surprise that on the 12-month lease anniversary the rental rate will most likely be increased by the owner to the allowable percentage . Most owners increase 2-5% in any given year and some don’t increase rents at all. Which means many landlords just received a pay raise.

- Rents roll back to what they were on March 15, 2019. Tenants that have experienced rent increases over the past few months will get relief on 1/1/2020 when their rent returns to whatever the amount was as of March 15, 2019 plus the allowable annual rent increase. Furthermore, the landlord will not owe the overage in rent charged back to the tenant.

- Provides more certainty to tenants of their rental amounts each year plus gives them adequate time (60-120 days) and monetary compensation equal to one – month of rent should they receive a notice to vacate.

- Tenant must have 12 – month continuous residency for Just-Cause and Non-Cause policy to apply. This means that landlords and property managers can put new tenants on month-to-month lease terms as part of a probationary period. If the tenant proves to be unlawful or cause issues an owner can choose to provide them with a notice to vacate prior to the 12 – month tenancy expiration. Another positive for landlords it provides them with a “grace period” if they lease a unit to an unqualified or unlawful tenant.

- Tenants will have protection of Just – Cause meaning that an owner will need to provide sufficient evidence that the tenant breached the lease agreement.

- Tenants will have the opportunity to cure a breach in the rental agreement within 30-60 days depending on the infraction.

- In the short-term it slows down the rate of displacement and relocation of residents which from a policy-makers standpoint is one of their primary goals.

- Benefits tenants that have lived in a unit for more than 12 continuous months because they receive immediate protection under AB 1482. Often times owners don’t increase rents to avoid turnover and the need for spending money in improvements.

- The bill may promote more new construction since it is exempt and there’s a vague clause that states any dwelling that has received a certificate of occupancy within the last 15 years is also exempt. Meaning, a building that is much older but renovated to the point that it required a certificate of occupancy would allow for market rate rents.

- Organization of owner records and documents are key for the profitability of a building. Owner’s should keep excellent records which will streamline all rent increases, evictions, refinancing, or a sale of the property.

- Owner’s will require much stronger qualifying criteria as it pertains to credit, income, employment history, criminal records, and past resident verification. Many private owners lease based on their gut feeling. Going forward, landlords should run thorough background checks using professional services to avoid leasing to unqualified tenants that interview well.

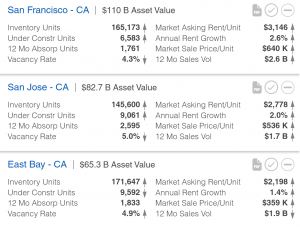

Evidence from rent – controlled markets such as San Francisco, San Jose, and Oakland show that over time not only do rents increase significantly but values do as well. The cause, supply and demand. There’s way more demand than supply plus which make any vacant units increase in market value. The chart below (CoStar Research) shows how high values and rents have become in SF, San Jose, and the East Bay of California. For example, SF has some of the most stringent tenant protection laws in the country and the average sales price per unit is $638,000! The argument from the opposition is that tenant protection laws cause prices to decrease but in the long-term history shows that prices actually increase. What about rents, the average asking rental rate in SF is now $3,146 per month the highest in the country since the average national rent is +/-$1,390 per month (CoStar Research). As the chart shows, San Jose and the East Bay are not that far behind in every category. SF implemented rent protection laws in 1979 which adjusted for inflation the average rental rate was +/-$1,375 per month. Keep in mind, that these market rents maybe reflective of non-rent-controlled units or those that may have been vacant. There are many rent – restricted units that are collecting much lower than the amounts shown in the chart. This may provide evidence that units under rent control make non-rent controlled units much more expensive to rent.

As it pertains to policy, tenant rent protection laws work well for residents already in housing providing them with certainty and reducing the risk of displacement through adequate Just/Non-Cause notices. The legislation really benefits those that are living in units where the rents are well below market and have not been increased in several years. AB 1482 also benefits landlords especially those that have not increased their rents in years because now they’ll have a set schedule for annual rent increases. Coincidentally, this will raise their annual gross income collected while at the same time giving tenants certainty of the rental amount they will owe on a monthly basis. Evidence also shows that landlords may experience significant asset price and rent inflation making their buildings much more valuable.

Overall, the benefits seemingly are in favor of the landlord versus the certainty it provides the tenant.

Join us next week on Friday 10/11 as we discuss the arguments against Rent Control, the CONS.