What are his proposed policies along with likely outcomes.

Donald J. Trump (DJT) was just voted in as the new President Elect of the United States marred by a very contentious election season. As he prepares to take the oval office, we’re starting to get indicators of how the market is reacting to his anticipated policies.

Furthermore, in many of his speeches or podcast appearances, DJT provided insight to his policies for the economy and we’re analyzing the possible impacts on the commercial real estate market (CRE).

DJT has many uphill battles which he didn’t face in the beginning of his last presidency in 2016. First and foremost, he needs to fight against the biggest tax that erodes consumers’ income, inflation, which correlates directly with interest rates.

Remember, DJT has been president, and we know that he’s generally very pro-business plus he owns a multi-billion CRE portfolio. The Republicans have control both of the House & Senate which means the majority of his administrations proposed policies will be implemented.

Clear outlook for Income Taxes, Capital Gains, 1031 exchanges, bonus depreciation.

Markets and investors thrive with clarity. If there’s no clear path ahead it leads to a stagnant economy where people would rather keep their money in the bank rather than putting it to work (risk).

Here is my assessment of what to expect as it pertains to each of these categories:

- Income Taxes: both corporate and personal income taxes will be reduced for all income levels at tiered amounts. This will create more disposable income for businesses and consumers.

- Capital Gains: for those that elect to pay capital gains on their profits, they’ll be paying less in taxes since the current tax rate will either remain the same or be lowered. Lower capital gains taxes means more transactions where there’s a substantial profit will occur leading to reinvestment or creation of other products.

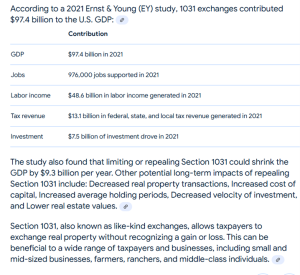

- 1031 Exchanges: current VP Harris had verbalized proposing the elimination or limits on the IRS 1031 exchanges which allows real estate owners to reinvest their gains into other like-for-like properties. The 1031 exchange is vital to real estate and the economy.

Eliminating the 1031 exchange is detrimental to all real estate owners especially private “mom and pop” operators. Ultimately, limitation or elimination would lead to a stagnant economy with very few properties trading hands and investors figuring out some sort of loophole or purchasing shares in a property to not trigger the capital gains tax.

Under a DJT administration the 1031 exchange laws will remain intact allowing sellers and buyers to transact properties they may have otherwise held. This provides investors with certainty that for the next four (4) years they can utilize the 1031 exchange to defer taxes.

- Bonus Depreciation / Cost Segregation: this is tool used by investors that qualify under “the real estate professional status” to purchase value-add real estate, make improvements to the asset, and accelerate the depreciation schedule to offset their income and pay less income taxes. This depreciation scale was previously 100% but over the years the depreciable percentage. There’s a strong likelihood that this administration will bring back bonus depreciation or start it back at a higher percentage. Bringing back bonus depreciation or increasing the percentage will spur more real estate purchases where the new owner makes significant improvements to the property. This not only incentivizes transaction volume but also improving tired properties.

Inflation, Tariffs, and Interest Rates

DJT has a serious conundrum on his plate to lower inflation meanwhile boosting the economy. Here’s an overview of what DJT has proposed and my commentary as to the economic impact.

- Gas Prices and Energy Costs: according to a podcast interview DJT indicated his first plan of action was to lower the cost of petroleum (gas) since inflation is directly correlated with the cost of energy. If he can succeed in lowering transportation, food, and electrical costs, DJT believes that cost of all other things will come down as well.

How will he accomplish this? Opening the approved Key Stone Pipeline, producing more domestic oil through ANWAR, and increasing fracking. This will lead to more domestic oil production creating lower prices via competition with OPEC and other distributors.

Oil is also necessary in electrical production; lower oil prices will lead to lower electrical prices thus providing businesses and consumers with more disposable capital.

The hope is that lower energy costs will get passed down to the consumer in the form of lower prices for goods and services.

- Trade Tariffs: DJT plans on reinstating trade-tariffs with some of our largest distributors of goods. The revenues generated from the tariffs will be used to offset our current deficit. The objective is to tax imports on countries that tax our exports, which will likely lead to a fair negotiation between trade partners.

The potential downside is that tariffs will increase the cost of goods for consumers until we have enough domestic production of the same good.

The potential benefit is that more domestic production of goods will lead to more business starts, higher employment, and more disposable income for consumers to spend.

- Interest Rates are directly correlated with inflation. When inflation is higher, interest rates increase to hedge against it and slow down the economy.

Conversely, when inflation is low near the FED’S target rate of 2%, interest rates tend to decrease. Although the Stock market rallied the day after DJT’s electoral win, the Bond market deteriorated causing mortgage rates to increase.

Bond traders view DJT’s proposed policies as inflationary in nature which is an issue because inflation is not yet tamed. Expect long-term interest rates to remain higher or elevated for longer.

The Conundrum

As previously discussed, DJT’s economic policies are growth oriented, they’ll likely provide businesses and consumers with more money. In addition, lowering energy costs with domestic production of essential resources will also lead to economic growth. Tariff taxes will result in higher prices of imported goods that we consume from China, India, and other trade partners, until we can produce the goods domestically or we reach a trade agreement.

In order to effectively lower inflation and offset the reduced tax revenues, DJT’s administration will be forced to reduce government spending significantly in other categories.

Final Thoughts

Overall, there’s optimism as it relates to the economy and real estate since his policies are generally business friendly. His biggest economic obstacle is dealing with inflationary pressures because there will be no noticeable improvements until it’s tamed and reduced to lower levels.

Expect interest rates to remain at higher levels for longer which I anticipate at 18-24 months until you start noticing some reprieve.

The certainty in the tax code as it pertains to real estate and businesses will allow owners to move their profits via selling or refinancing. Expect transaction volume to increase in the next 12 months at equitable prices for all parties.

Remember, Donald Trump built his enterprise through commercial real estate, and real estate has always been one of the main driving factors of our economy. Private individuals have created financial freedom and generational wealth via real estate. DJT will pass or protect policies which will benefit CRE owners and the industry.

I anticipate a status quo economy for the next 12-18 months, we won’t start to realize any tangible benefits until the second portion of his presidency.

Authored by: Adrian Del Rio