If ChatGPT tracked the most commonly used phrase in real estate since 2024, it would be, “I’m waiting for interest rates to come down.”

One of my New Year’s resolution was to not be the interest rate prediction wizard, which is why I’m just explaining just the data along with supporting graphs.

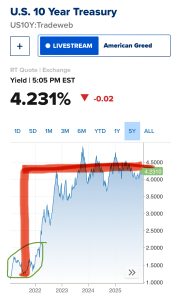

Long-term commercial mortgage rates are comprised of either the 5 or 10 year Treasury Yield. The yield is the banks/lender’s cost for using the money, then lends the money out to the consumer with a margin or spread (i.e. profit).

The image below shows the 10 Year Treasury yield as of 1/23/26 which is 4.23%. In comparison, the lowest point in the last five years occurred in 2021 at 1.09% yield.

You’ll notice that the 10 Year Treasury has started to trend upwards which means that interest rates have increased slightly.

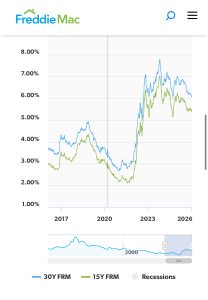

Furthermore, the image below directly from Freddie Mac’s data shows the interest rate history dating back to 2017 (9 years) for both 15 & 30 year mortgages.

You can see how much higher rates are still today compared to the low interest rate and peak property price era of 2020-2023.

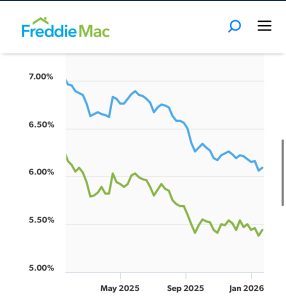

The chart below from Freddie Mac is a zoomed in look at the past year of interest rate fluctuation. Notice that the last most graphed point is trending upward. The data indicates that rates have likely hit a floor and are stubbornly remaining stable at this floor.

What does this all mean?

There are so many factors contributing to interest rates remaining higher, although the main factor is that the US Economy remains very resilient. Also, there will be a new Fed President in a few months, so rates will hold at their current levels until there’s more certainty.

For now, interest rates will remain at their current levels for longer in the 6- 6.5% range. It was widely anticipated that interest rates would go down at a faster rate, however the data is indicating that sellers, buyers, and borrowers should expect current rates to be the new normal.

The buyer activity is significantly higher in the new year compared to 2025. Sellers that price their property at today’s market prices, which are still historically high, will sell. If you’re a borrower needing to refinance, my recommendation is not to wait for lower rates, instead potentially look at doing a variable rate with a lower floor or get a fixed rate with no pre-payment penalty.