IMAGE FROM BANK RATE.com

Chairman Powell delivering his FOMC Speech

On September 18th, FED Chairman Powell announced a 50 basis points (BPS) but to the Fed’s Fund rate. This was considered a “drastic” move by the FED because the treasury bond market had factored in a 25 BPS cut.

On the surface this FED rate cut was widely celebrated my many because they believe it signals a return to the lower rates of 2020-2022, stimulating the economy back to vibrant times. Realtors are expecting more transaction volume, lenders to fund more loans, sellers to get higher prices for their properties, and buyer’s making deals pencil.

Here’s my analysis of the rate cut, the FOMC statements, and what to expect moving forward.

- As a refresher, the FED Fund rate that was cut primarily affects the rates on consumer loans such as HELOC’s, auto loans, credit cards, and business lines of credit, not mortgages.

- Did interest rates go down when the FED cut rates? No, mortgage rates slightly increased over the course of the week.

- Why did mortgage rates increase if the FED cut rates drastically by 50 BPS? The mortgage rates leading up to the 9/18 FOMC meeting had already factored in a Fed rate cut from the statement made at their August meeting. Plus, the markets did not anticipate such a large rate cut signaling that there are other problematic issues facing our economic growth.

More importantly, the statements made by Chairman Powel were interpreted by the secondary market as being bearish (bad) on the economy which is why they decided to cut rates.

*Furthermore, the FOMC indicated that they anticipate another 50 BPS rate cut by year end 2024! Yet, mortgage rates didn’t rally or improve with this indication.

Reason: This signals that the FED is attempting to ease their monetary policy by providing indirect liquidity through the consumer into the economy.

These were a few of the highlight statements from the FOMC Meeting by Chairman Powell along with my translation comments:

- “Economic activity has continued to expand” è Translation: Inflationary

- “Growth in consumer spending has remained resilient” è Translation: Growth = Inflation

- “In the labor market, conditions continue to cool, nominal wage growth has eased over the past year, and the jobs to workers gap has narrowed” è Translation: Unemployment is increasing, and wage growth is down.

- “Long-term inflation expectations appear to remain well anchored.” è Translation: short-term inflation is not in check yet.

- “As inflation has declined, the upside risks to inflation have diminished and the downside risks to employment have increased” è The data shows unemployment is increasing quickly plus they anticipate higher unemployment.

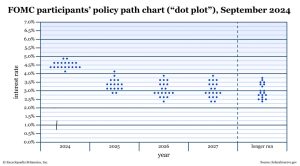

The “Dot Plot Map” is a term mentioned numerous times the last meeting. What is the Dot Plot Map?

It’s a dotted graph showing where the Governing Members (Governors) of the Federal Reserve the Fed’s fund rate will be over the next few years.

See chart below provided by Brittanica

The consensus is that from 2025 – 2027 the FEDs fund rate will remain around 3-4%. What concerned the bond market is that in years 2026-2027 more members voted for the fund rate to decrease between 2.75-3% signaling that they anticipate a potentially deeper recession.

For perspective, when mortgage rates were 2.5-3.5% the Fed’s fund rate was 0.25% – 0.65%. This means this next cycle don’t expect mortgage rates to be that low.

The underlying issue as to why the bond market didn’t rally for lower mortgage rates is because the Fed slashed the fund’s rate to promote liquidity however, short-term inflation is not yet contained. This is a main cause of why interest rates increased on the same day the FED decreased their rate.

Bond analysts are concerned that inflation will return with a lower Fed’s fund rate pushing more money into the economy.

Here’s my summary of it all and what I anticipate for the next 12 months:

- Today’s mortgage interest rates have settled which had already accounted for a September rate cut.

- The FED is signaling that we’re in a recession and unemployment will continue to rise.

- The FED’s rate cut, and future rate cuts will provide liquidity to the market in the form of lower payments on consumer debt however will lead to more inflation.

- Although the FED will reduce it’s fund rate 100-150 BPS (or greater) points over the next 18 months, mortgage rates will remain in the 4.5% – 5.5% range as bond markets will be most concerned about persistent inflation.

- The next eighteen (18) months will be a fruitful opportunity for sellers, owners, borrowers, buyers, lenders, appraisers, and brokers as transaction volume will increase.

- New construction starts will increase with lower borrowing rates which will help in stabilizing rents.

Keep in mind that the Federal Reserve doesn’t control the economy. They have a couple of tools to help stimulate or constrain it however free market forces are the key drivers. This is a good thing because I’m not interested in a government entity having the ability to start and shut off the economy.

My biggest recommendation whether you’re an owner with a loan term coming that needs to refinance, a seller of a property to cashout or exchange into a move-up investments, or a buyer interested in adding more to their portfolio or entering the market, is get all your financial record keeping in order and be ready to execute.

Written by Adrian Del Rio

We Sell Commercial Properties, I buy them too!