I put this blog site together for private investors, also referred to as “mom and pops”, to provide them with relevant and localized real estate content. Mom and pop investors make up a big majority of property owners, yet they’re very underserved and being left behind in this rapidly changing tech economy coupled with new government restrictions. We’re experiencing one of the biggest economic wealth shifts in history, it’s our duty to preserve privately-owned family businesses through content.

Small family owned businesses and real estate are the life blood of our economy which we must protect vigorously against fear mongering and institutional investors.

The purpose of this Blog is to post once a week on the current market events, legislation, trends that will affect the regional and local real estate market. I will not be discussing presidential tweets, political debates, or what each invited guest had for dinner at the White House. This Blog will focus on data, analytics, legislation, and experiences that are pertinent to our real estate economy in Northern California and throughout the Central Valley. I will cover topics such as AB1482 (the proposed CA blanket Rent Control Act) along with overviews of rents, prices, how to use technology in your real estate business, and so much more. I’ll also discuss various asset classes such as apartments, retail, industrial, mobile home parks, and self-storage.

My goal is to provide relevant content so that private and family-owned real estate companies can make educated decisions based on facts, not emotion. Every market is cyclical and each cycle is different which makes it so important to research the actual data and not listen to all the noise you’re bombarded with on the news. Previously, I missed countless opportunities because I did not attend local investor meetings or research the factual data and trends. I don’t want to miss these opportunities anymore which is why I’m dedicating myself to delivering the facts. I’m mastering my craft of real estate and delivering my results to those that want to grow. I’d like to anticipate the next market cycle and not focus on the past but what is coming. The great Wayne Gretzky said “I skate to where the puck is going to be, not to where it has been.”

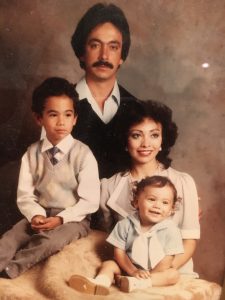

See, I too grew up in a small business! I’m the son of Mexican immigrants who came to this country with very little seeking better opportunities. My parents started a roofing company with very little money when I was a young boy. With lots of stress, tough times, droughts, and feast or famine cycles they persevered. The company grew exponentially which allowed my folks to start investing in real estate.

My favorite “shop local” quote that summarizes my adolescent life is one that I’ve modified that reads, “when you buy from a small business, you are not helping a CEO buy a third vacation home. You are helping two little boys attend private elementary school, little boys get their team jerseys and cleats for soccer, my mom put food on the table, my family pay for the mortgage and for college tuition, not to mention making payroll for the 50 employees that help the business operate.”

Fast forward twenty years and now it’s my turn. My wife and I own PCG Commercial an investment property brokerage firm plus a small self-managed portfolio of multifamily apartments. I sell properties throughout N. California and my biggest competitors are national brokerage firms that boast having international clients, while the majority of buyers are LOCAL to the region or market!

To those that contend that we cannot compete against these big companies, I argue the contrary. I have a huge competitive advantage since I learn about the neighborhood schools, employers, restaurants, wholesalers, vendors, attractions, and so much more that the big players may not. I pass this market knowledge on to our private clients that are newly coming into a market or our well rooted buyers that already own in these areas. Furthermore, our clients aren’t dealing with investor funds which means they don’t have to achieve certain IRRs, preferred equity returns, or waterfall profits over a designated time period. The goal of private-owners is to make enough cash-flow, equity, and or profit to cover their cost of living and future retirement. Many of them desire to leave assets for their children to build on. The American Dream!

For this grand plan to succeed, the ultimate responsibility falls on private-owners and family businesses. Meaning, you’re not entitled to revenues just because you’re local, organic, or a well-known investor in the market. Your business needs to offer what the bigger corporate structures cannot. See, if you want to automate your outward business to the consumer to make your life easier because it won’t involve any human contact then you’ve already lost. Remember, owning a business comes with problems, solutions, and is HARD WORK! The objective is to automate your inward facing business with your employees while providing the consumer/tenant with personable customer service. People want human contact with a live person that will listen not some automated or template response. In a world filled with very little emotion because computers and text have taken over our communication, people are yearning for personal and timely solutions not a corporate hierarchy.

People are tired of automation which means small businesses that can figure out how to provide human interaction, with hospitality, excellent customer service, plus deliver high quality products that create long-term and repeat clients will profit by default. Investors, business owners, vendors, and suppliers need to shift their focus from the bottom line to the top line by focusing on abundance not scarcity. Focus on giving a superior experience and product with competitive pricing to whoever you’re dealing with while focusing on profit last. I’ve learned from experience that the more I focus on giving I receive much greater in return (I will discuss this in further detail in a later Blog Post). Tenants (which I refer to as Residents) and consumers want to be treated with respect not as a rent increases or a nuisance. At the end of the day remember without our residents and consumers we wouldn’t be able to pay for our mortgages, groceries, soccer cleats, piano lessons, college tuition etc. I believe that there’d be less government legislation if businesses treated the consumer as a human not as profit.

My parent’s “small” business provided my brother and I with so much abundance. It came with many sacrifices, stress, and sleepless nights which were all worth it in the end. I want to see more private family-owned businesses start, thrive, and continue through the generations to keep the American Entrepreneurial Spirit alive!

*Tune – in next Friday for my next Blog on Rent Controls and how it WILL impact CA multifamily real estate*